Including Business News

January 10th 2023

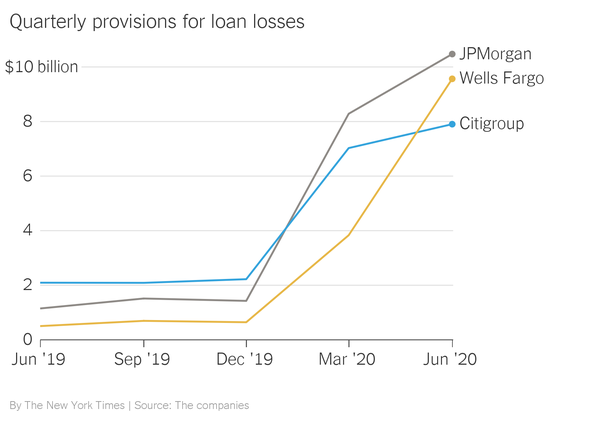

The football World Cup in Qatar was not the only show drawing attention to the oil-rich Gulf in recent weeks. In Abu Dhabi, an annual finance conference was so packed that attendees were left with standing room only as the region is increasingly viewed as one of the remaining sources of abundant capital. When sessions ended, bankers and investors squeezed through corridors pitching deals on the hoof. “It was so busy, it felt like the whole island sank a little,” one Abu Dhabi official quipped to a banker present. There were similar scenes in neighbouring Saudi Arabia, where the kingdom’s so-called “Davos in the Desert” investor conference drew record numbers with more than 1,000 “global executives” attending, including about 400 from the US and scores from Europe. For many of those beating a path to the Gulf there is one thing on their minds — luring capital from, and striking deals with, sovereign wealth funds as the region enjoys its first petrodollar-fuelled boom in a decade. “You have the world and his wife coming here looking for capital,” says a veteran Gulf-based banker. “It feels like 2008.” That was the year that thrust many of the Gulf’s SWFs into the spotlight as oil prices soared to a record $147 a barrel, while much of the rest of the world suffered the global financial crisis. Back then it was Abu Dhabi’s stable of investment vehicles and the Kuwaiti and Qatari SWFs that made the biggest splashes. These funds became go-to investors for distressed western assets desperate to raise capital. Citigroup, Credit Suisse, Barclays and Daimler were among high-profile companies and brands bolstered by injections of Gulf petrodollars. Attendees at the Future Investment Initiative conference in Riyadh last year Attendees at the Future Investment Initiative conference in Riyadh last year. The event, nicknamed ‘Davos in the Desert’, drew record numbers, including scores from the US and Europe © Tasneem Alsultan/Bloomberg Today, the SWFs are once again eyeing opportunities amid another bout of global tumult, buoyed by petrodollar surpluses after oil prices last year reached their highest levels since 2008. While much of the world braces for recession, the IMF forecasts that the Middle East’s oil and gas producers are set to reap up to $1.3tn in additional revenues than had been expected over the next four years as energy prices were pushed up by Russia’s war in Ukraine. Much of it will flow to the Gulf, home to top crude exporter Saudi Arabia and the largest liquefied natural gas exporter Qatar. It is a boom that is set to bolster the soft power of the region’s increasingly confident absolute monarchies, notably Saudi Crown Prince Mohammed bin Salman as he seeks to defuse criticism of his regime’s human rights record and project the kingdom as a major G20 power. “The quantum available is massive,” says an investment banker. “For the last two months, every week we have one or two companies here, primarily from the US, but also Europe, China, India, doing roadshows.” Yet Gulf officials caution there are differences with 2008. Although they consider this as a moment to capitalise on, this time they say the investments will be done in a more strategic and less opportunistic manner. “It’s not about the deal flow that is seeking us out. We want the deal flow that fits with our strategic ambitions,” says Khaldoon Mubarak, chief executive of Mubadala, a $284bn Abu Dhabi sovereign fund that has investments in more than 50 countries. “In 2008 we reacted well, but this time our approach is more proactive and strategically deliberate.” Experienced investors The Middle East’s sovereign wealth funds are bigger and more experienced than in 2008. Mubadala managed assets of just $15bn during that period. Abu Dhabi, the wealthy capital of the United Arab Emirates, has also consolidated funds over the past decade after two of its vehicles — Aabar and Ipic — got sucked into Malaysia’s 1MDB fraud, which became one of the world’s biggest financial scandals. The $450bn Qatar Investment Authority was just three years old in 2008 and often appeared to act on impulse rather than strategy. “We were very young [in 2008] — the teams were a bit smaller and we were building the portfolio from scratch, so we were more opportunistic,” says Mansoor bin Ebrahim al-Mahmoud, QIA chief executive. “Nowadays, it’s totally different. We are mature, well established, with specialised teams and a robust asset-allocation strategy.” He is eyeing an “opportunity to reposition our portfolio in certain directions, to fill certain gaps or correct overexposure”. It’s kind of the first thing people think about — we need strategic capital, where are the sources? Yet one of the main draws for investors this time round is a fund that sat on the sidelines during the 2008 boom — Saudi Arabia’s Public Investment Fund, or PIF. It has undergone a radical reinvention since Prince Mohammed took over as chair in 2015 as it has been tasked with leading Riyadh’s grandiose plans to overhaul its rentier economy. It has committed to spending hundreds of billions of dollars at home, while using its newfound financial and political clout to diversify the kingdom’s overseas exposure. It is also pursuing strategic investments to lure technology and knowhow onshore to bolster Riyadh’s development plans. “It’s massive asset management, a sovereign wealth fund, a conglomerate and a government policy extension all combined into one,” says another senior investment banker, with a “tremendous appetite” for opportunities. Rizwan Shaikh, co-head of emerging markets at Citigroup’s banking, capital markets and advisory division in Emea, says: “We have to be selective in terms of who we bring in to put in front of the funds, but they are keen and want to see what’s out there.” At the same time, he says the main inquiries his bank is receiving are from clients looking for capital and strategic partners. “It’s kind of the first thing people think about — we need strategic capital, where are the sources?” A delicate balance The new phase of dealmaking by the Gulf’s SWFs began with the coronavirus pandemic. Mubadala invested a record $30bn in 2021. Last year, it committed to investing £10bn in the UK over five years, and has already deployed about half of it. Its younger sister, ADQ, has been on the acquisition trail across the Middle East, north Africa and Turkey. Even Adia, Abu Dhabi’s most traditional and conservative SWF, has been investing at a high velocity. Some, however, believe there is still time for asset prices to fall further, meaning they are not in a rush. “Is it a market where you have a lot of cheap assets and it’s time to attack? No, I think there’s a lot more pain that’s still coming,” says Mubarak, chief executive of Mubadala. “We’re careful how we deploy our powder. We’re well positioned in terms of liquidity and in terms of access to deal flow.” Elsewhere, the QIA’s largest investments last year include €2.4bn in German power company RWE and $1.5bn in Bodhi, James Murdoch’s media venture in India. It was an anchor investor in Porsche’s initial public offering. A picture from last year of two women in an electric car in the Red Sea port of Jeddah Saudi Arabia’s PIF continues to be highly active, launching domestic companies ranging from an electric vehicle brand to a coffee business © Amer Hilabi/AFP via Getty Images In Saudi Arabia, the PIF has done fewer of the sort of big-ticket deals it did in 2016 when it took a $3.5bn stake in Uber and pumped $45bn into SoftBank’s floundering Vision Fund. But it continues to be highly active, launching myriad companies at home, from a Saudi electric vehicle brand, Ceer, to coffee and aircraft leasing companies, while also trading billions of dollars in overseas stocks. The fund’s foreign exposure has surged from 9 per cent of its assets in 2017 to about a quarter in June, while the size of the fund has swelled from about $150bn seven years ago to more than $600bn. Its target is to reach more than $1tn assets under management by 2025, with about 30 per cent in international investments. Noticeable global deals this year include its decision to pump more than $3bn into gaming companies, including taking a 5 per cent stake in Nintendo. The PIF’s transformation underscores the dramatic shift in the kingdom’s risk appetite and the way the leadership intends to manage its wealth. In the past, Saudi governments typically used boom periods to dispense largesse to the population through benefits, subsidies and public sector wage increases, while also embarking on a flurry of state spending on infrastructure projects. Charts showing Saudi GDP growth and budget balance That would propel growth in the state-dominated economy, but lead to cycles of boom and bust, with the latter characterised by yawning deficits, stalled projects and delayed payments to contractors. Any money that was saved would be tucked away at the central bank and conservatively managed. Today, much of the state spending is channelled through the PIF and a National Development Fund, which are expected to be the main beneficiaries of the recent surpluses. “We don’t want money sitting idle yielding zero,” says finance minister Mohammed al-Jadaan, who also is a member of the PIF board. The delicate balance Riyadh wants to strike, he says, is maintaining fiscal discipline while also taking advantage of the opportunities presented by the boom. He insists that Riyadh has strengthened its institutional capacity to monitor the efficiency and control of state spending, saying it is using a data-driven approach to prioritise projects based on potential economic return. As an example, he cites the establishment of a “spending efficiency centre”, with more than 500 staff, to help avoid “a rush in spending without proper plans”. It has generated direct and indirect savings of $186bn since 2016, according to the ministry. Designs from an exhibition for the Line, part of the futuristic city of Neom Designs from an exhibition for the Line, part of the futuristic city of Neom. Experts say the cost of the Saudi crown prince’s flagship megaproject will far exceed $500bn © Blondet Eliot/ABACA/Shutterstock The goal, Jadaan says, is “how to avoid projects from going bust when we have seen hundreds and hundreds of projects [in the past] start strong and then in the middle for whatever reason . . . are not completed”. He adds that the difference today “is you are investing when there’s capacity in productive assets, in assets and expenditure that will create more jobs and grow the economy”. Riyadh has already used the windfall to accelerate projects, Jadaan adds, citing logistics as the kingdom plans to develop a railway network connecting the east and west, and Red Sea ports. “We are taking advantage of this moment as we speak,” he says. “We are going to spend more when we have more money, and we may even borrow more.” The PIF raised $17bn in November through a syndicated loan, weeks after it raised $3bn through a green bond, a nod to the fact that even with the kingdom’s oil wealth, the fund will need to borrow to meet its large commitments. Steffen Hertog, a Gulf expert at the London School of Economics, says that while the finance ministry has put in more controls on spending, it is the PIF’s activities that raise concerns, adding that “we get almost no disclosure on the spending they undertake”. The Abu Dhabi Global Market Authorities building in the UAE capital The Abu Dhabi Global Market Authorities building, centre, in the UAE capital. Officials talk of using sovereign funds to help accelerate the development of the financial centre © Christopher Pike/Bloomberg That the PIF, and some of the projects it oversees, are using debt also creates potential sovereign risk, he adds. Even with the windfall, questions linger about how the PIF will meet its financial commitments. Experts say just Neom, the futuristic city that is Prince Mohammed’s flagship megaproject, will cost far more than $500bn originally stated. “In a way it’s actually potentially even less accountable and less transparent than the previous sort of spending booms,” Hertog says. “It’s more speculative than the capital spending that you would have had under governments. It can create higher returns but is also riskier; some people are worried about that.” ‘Almost nationalisation in reverse’ A key focus among officials in Saudi Arabia and the UAE in the current boom is to utilise state funds to bring companies to their shores to support domestic development plans. It comes as economic competition heats up in the region. In Abu Dhabi, officials talk of using the funds to help accelerate the development of tech and renewable energy hubs, as well as the emirate’s financial centre, ADGM. As part of the latter strategy, Abu Dhabi is promising to commit seed capital to private equity funds willing to set up in the ADGM. “The private equity market is changing. Today there’s an opportunity because most people are scaling back and we have the ability to scale up,” says Mubarak, of Mubadala. Yet in terms of scale and ambition, nothing compares to what the PIF is attempting to achieve in the Gulf’s largest economy and most populous nation. As it has become the dominant economic force in Saudi Arabia, it has created more than 60 new domestic companies over the past seven years. It expects to invest $40bn annually in the economy over the next decade, with its mandate covering everything from developing a new airport and airline, to incubating and growing new industries and driving vast infrastructure projects. “It’s almost nationalisation in reverse,” says a senior investment banker. “Everything else is going to get crowded out.” The Saudi state-owned Ma’aden plant in Ras Al-Khair The Saudi state-owned Ma’aden plant in Ras Al-Khair. The PIF’s strategy focuses on sectors where Riyadh believes it can utilise domestic resources, such as mining and building materials © Mohammed Al-Nemer/Bloomberg The PIF’s domestic strategy includes an emphasis on sectors where Riyadh believes it can expand industries utilising domestic resources, such as mining and building materials, as well as projects designed to reverse the tradition of Saudis going abroad for shopping, tourism and entertainment, and support the nation’s development, including housing, healthcare and financial services. But other areas where there is high local demand, but limited supply, such as automotives or defence, will require the PIF importing capacity through acquisitions. To support this, the fund’s MENA and international investment teams can co-ordinate on investing in foreign stocks that fit with the domestic programme. The clearest example is the PIF’s 62 per cent stake in Lucid, which led to the electric vehicle maker establishing a manufacturing hub in the kingdom. Hertog says Saudi Arabia in particular is likely to need to acquire majority stakes to lure that foreign direct investment it is seeking, saying “companies could promise them all sorts of things to get capital injections”. “But you’ll have a real principal agency problem — where the company wants capital, but it doesn’t want to invest in Saudi,” he says. “You will be back to that logic of kind of offset deals in defence, where companies have to sort of go through the motions and invest locally without really wanting to do it.” Previous efforts by Gulf states to bring industry to their shores, be it Saudi Arabia’s past ambitions to develop auto manufacturing, or Abu Dhabi’s plans to establish a semiconductor plant in the emirate after Mubadala pumped billions of dollars into semiconductor firm GlobalFoundries, never made it off the drawing board. And Saudi Arabia’s history is littered with projects that have either stalled or failed. Still, the veteran Gulf-based banker says while it is inevitable that resources will be wasted, “what’s more striking is each country has entities that seem better able to manage the money”. The risks, he says, “are we go backwards in terms of greed and corruption because there’s so much money around”. For now, though, the mood in the Gulf is one of confidence. “We will make mistakes, but overall I think we are doing a great job,” says Jadaan. “We are very confident, [but] cautious, obviously the world is in turbulence and we are not isolated.”

May 3rd 2022

Fed carries out historic interest rate hike in attempt to counter inflation

by Zachary Halaschak, Economics Reporter

The Federal Reserve announced its most aggressive interest rate hike in more than two decades and said it would shrink its balance sheet in response to the excruciating inflation afflicting the economy.

Following a two-day meeting, the Federal Open Market Committee announced Wednesday that it would increase its interest rate target by half of a percentage point. The central bank typically raises rates by just a quarter of a percentage point, so the move signals that the Fed is highly concerned with the soaring prices.

Consumer prices increased by 8.5% for the 12 months ending in March, as measured by the Consumer Price Index, the fastest clip since 1981, during the Great Inflation. The inflation is rippling through all parts of the economy, although energy prices and food prices in particular have exploded over the past several months, hurting consumers by making staples like gas and groceries increasingly more unaffordable.

The aggressive move by the Fed this week was expected, with investors already pricing in the half-point hike. Powell has been messaging that the move was coming over the past several weeks and has taken an increasingly hawkish tone when speaking about monetary policy.

Read More Fed carries out historic interest rate hike in attempt to counter inflation | Washington Examiner

Comment From the moment I started Advanced Level economics in cash strapped 1968, I was reckoned to be a brilliant student. I could not understand why I was given adulation for a subject all so obvious. Meanwhile I struggled with maths and music, real hard subjects . Economics was easy, so why the plaudits. Why isn’t it obvious what is happening here. The Anglo U.S elite invested in a resource access grabbing war on Ukraine , setting Russia up , with Zelensky as manically actor like egotistic applause hungry their stooge.

Consequently , energy and transport costs have gone through the roof, sanctions on Russia have added to most serious economic damage already established by social controlling anti social Covid measures. More money has gone into fewer hands, consumption has fallen, arms makers and oil companies get richer , while the masses get poorer.

I spent 14 months working in the vile City of London , where it was all about money. They know jack shit about Russia , other than the same old Cold War Garbage and orgasm to the sound of martial music.

Raising interest rates , to suppress demand ,will actually boost inflation and make the ever rich richer. The western economies are already depressed, but simple maths set theory is way beyond the stupid ‘uni’ educated self important little boys and girls.’ The media will pump out more of the ‘patriotic jingoistic ‘garbage and on it goes till goodness knows when.

Miss Roberta Jane Cook.

Crude Oil Prices Fall as China PMIs Flag Collapsing Demand

Investing.com

By Geoffrey Smith

Investing.com — Crude oil prices fell sharply on Monday in response to fresh data detailing the Chinese economy’s struggles with Covid-19.

By 10:25 AM ET (1425 GMT), U.S. crude futures were down 2.8% at $101.75 a barrel, while Brent futures, the global benchmark, were down 2.6% at $104.32 a barrel.

Read More Crude Oil Prices Fall as China PMIs Flag Collapsing Demand (msn.com)

April 9th 2022

Vladimir Putin

is taking global markets back to the noughties

Katie Martin

Around the turn of the century, currency traders, hedge funds and heavy-hitting economists obsessed over central banks’ foreign exchange reserves.

The euro was a baby, and backers faced a daunting task raising it as a currency with global impact, enmeshed in international trade and investment. Any data suggesting it was eating into the dollar’s dominance in global central banks’ coffers was taken as a sign of progress towards that aim, and produced abrupt shifts in the euro’s exchange rate.

Read More Vladimir Putin is taking global markets back to the noughties (msn.com)

March 21st 2022

Earmarks are back, and they’re as lousy as ever

by Washington Examiner | March 21, 2022

One of the worst decisions by the current Democratic congressional majority, and one of the main reasons it ought to be taken away, is the decision to restore earmarks. Republicans had wisely banned these specific-interest spending provisions after winning back the House majority in 2010. They need to do it again.

Unfortunately, members of both parties are already taking full advantage of this unfortunate decision. Democrats and Republicans alike are securing and boasting about the millions in wasteful pork-barrel spending that they brought home to their own states and House districts in the spending bill they just sent up for President Joe Biden’s signature.

Read More Earmarks are back, and they’re as lousy as ever | Washington Examiner

March 15th 2022

A Balloon

Wholesale Inflation Hits Double Digits; Ford To Start Shipping Cars w/o All Parts | NTD BusinessNTD BUSINESSPAUL GREANEY

Oil prices fall to their lowest levels in weeks, under $100 a barrel. What’s behind the drop in prices?

Prices keep rising and producers are feeling the pain. We talk to one manufacturer who says they are getting hit in every direction.

Gas prices are still soaring. We have some tips to help you save money at the gas pump.

Starbucks is teaming up with a major carmaker to offer electric car charging at its coffee shops.

Comment Politicians driving the moralising war mongering poison are insured against hardship, voting themselves pay rises for their role in this jingoistic disaster. Importing as much Islam as possible here, is very important, reinforcing fear and training them to bow to authority.

R J Cook

March 14th 2022

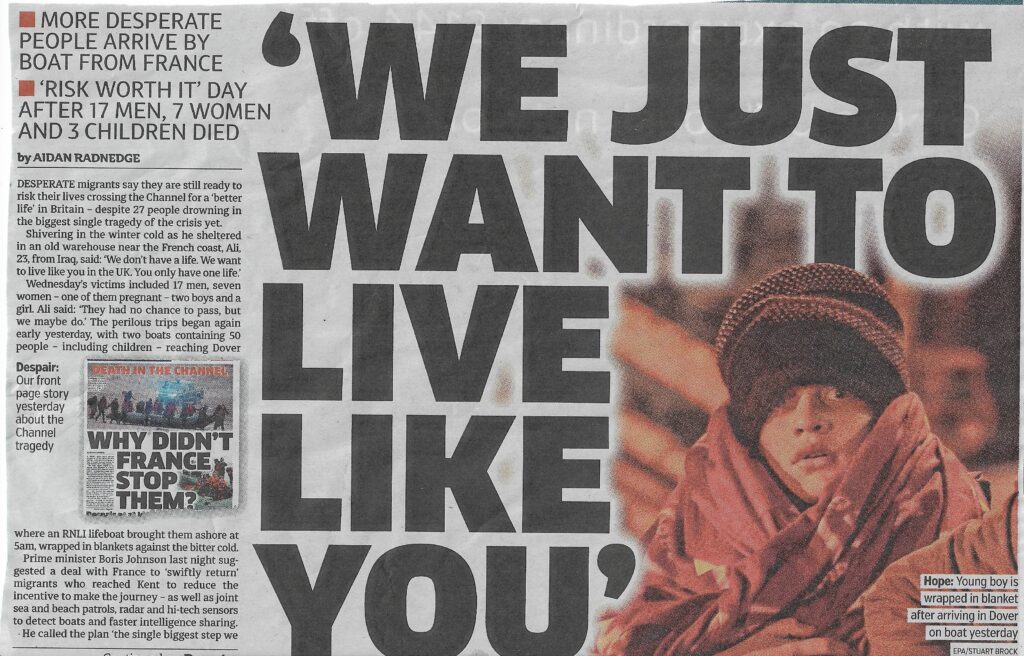

Economic hardship awaits millions living in Europe and the world beyond this year as authorities battle mounting political chaos. The issues stand to bite Britons the hardest, as the Government also cements plans to hike National Insurance rates to fund social care. Interest rates could add another aggravating factor into the mix as people struggle to borrow money from leading banks.

Russia, Belarus squarely in ‘default territory’ on billions in debt -World Bank

By Andrea Shalal

WASHINGTON (Reuters) – Russia and Belarus are edging close to default given the massive sanctions imposed against their economies by the United States and its allies over the war in Ukraine, the World Bank’s chief economist, Carmen Reinhart, told Reuters.

Russia, Belarus squarely in ‘default territory’ on billions in debt -World Bank (msn.com)

March 8th 2022

‘Defending freedom will cost’: US bans Russian oil and gas imports and UK will stop using Russian oil this year

John-Paul Ford Rojas, business reporter 3 hrs ago

US President Joe Biden has banned Russian oil and gas imports, calling it a “powerful blow” to “Putin’s war” – and the UK has said it will stop importing Russian oil by the end of this year.

Mr Biden vowed “to keep pressure mounting” on Vladimir Putin and his “war machine” over the invasion of Ukraine.

“The US is targeting the main artery of Russia’s economy,” he said.

Mr Biden warned Americans that “defending freedom is going to cost” – with motorists in the world’s biggest economy, already gripped by a cost of living crisis, likely to face higher prices at petrol pumps.

Comment It is not going to cost the well off and the elite. The lower classes will pay. The whole war was provoked by NATO. Russia has nowhere to go. The threat to their security ever since the 2014 Anglo U.S led coup, along with genocide in the Donbas by Zelensky’s mob, is never mentioned on Western media. R J Cook

March 2nd 2022

JCB, Burberry and Asos join widening corporate boycott of Russia

Laura Onita, Simon Foy, Louis Ashworth

JCB, Burberry and Asos have joined corporate giants including Mercedes-Benz and Exxon Mobil in cutting ties with Russia as the country’s descent into pariah status continues following its invasion of Ukraine.

JCB, led by Lord Bamford, said it had paused all operations, including the export of machine and spare parts in the country, where it has a small “assembly plant”.

Read More JCB, Burberry and Asos join widening corporate boycott of Russia (msn.com)

Comment Presumably Russia could start making its own JCB parts and JCBS. Same goes for everything else. R J Cook

February 27th 2022

‘Sell everything NOW before 50% crash as Putin drives nail in bull market’ – dire warning

Harvey Jones

The stock market crash is set to crash by 50 percent as the Russian invasion of Ukraine triggers global instability and inflation skyrockets. Shares are already hugely overvalued and investors should sell now and move HALF of their money in cash as protection, he said.

Read More ‘Sell everything NOW before 50% crash as Putin drives nail in bull market’ – dire warning (msn.com)

February 18th 2022

Announcing my new project, my new fight for your financial independence…

Join Fortune & Freedom today!

- You’ll get the truth about your money – behind the headlines, jargon and spin

- Smart ideas about how to inveRead st from real experts, whom I trust

- Intelligent insight, in plain English, about the threats to your money and how to avoid them

- Free, uncensored, direct to you – sign up now for Fortune & Freedom

YES, I WANT TO TAKE BACK CONTROL

OF MY MONEY!

Read More The Financial Crisis No One is Telling You About (fortuneandfreedom.com)

February 17th 2022

Plunder, Pillage, and Democracy?ABOUT THE BOOKDUSTIN BASS

Arthur Herman has written an incredible book on the legacy of the Scandinavians, starting with the Vikings. “The Viking Heart: How the Scandinavians Conquered the World” creates a timeline from one of the most feared people to walk the earth to the earliest practitioners of democracy, to legendary heroes, to a people who in many ways saved modern humanity.

Arthur Herman is the author of the new book, “The Viking Heart: How the Scandinavians Conquered the World”. He has written numerous bestselling books, including “Gandhi Churchill: The Epic Rival That Destroyed an Empire and Forged Our Age”, which was a finalist for the Pulitzer Prize in 2009. He is the author of “Douglas MacArthur: American Warrior”; “1917: Lenin, Wilson and the Birth of the New World Disorder”; “Freedom’s Forge: How American Business Produced Freedom in World War II”, which the Economist named as one of its Best Books for 2012; and one of my favorite books, the New York Times bestseller “How the Scots Invented the Modern World”. He is a senior fellow and director of the Quantum Alliance Initiative at the Hudson Institute and a regular contributor to various publications, including National Review, Commentary magazine, and The Wall Street Journal.

Follow EpochTV on social media:

Facebook: https://www.facebook.com/EpochTVus

Twitter: https://twitter.com/EpochTVus

Rumble: https://rumble.com/c/EpochTV

February 12th 2022

It’s not quite the Black Death, but worker shortage hits UK firms hard

Larry Elliott and Richard Partington 1 hour ago

A deadly virus arrives from the east and sweeps through western Europe for two years. The pandemic devastates the country’s economy and drastically reduces the number of available workers. Those who survive find they are in a strong position to secure a higher price for their labour.

That was the England of the 1350s in the aftermath of the Black Death, when emergency measures were brought in to cope with labour shortages. And, while the death toll from Covid-19 is nowhere near as severe as the drop – of at least a third – in England’s population between 1348 and 1350, the outcome for today’s economy is in some ways similar.

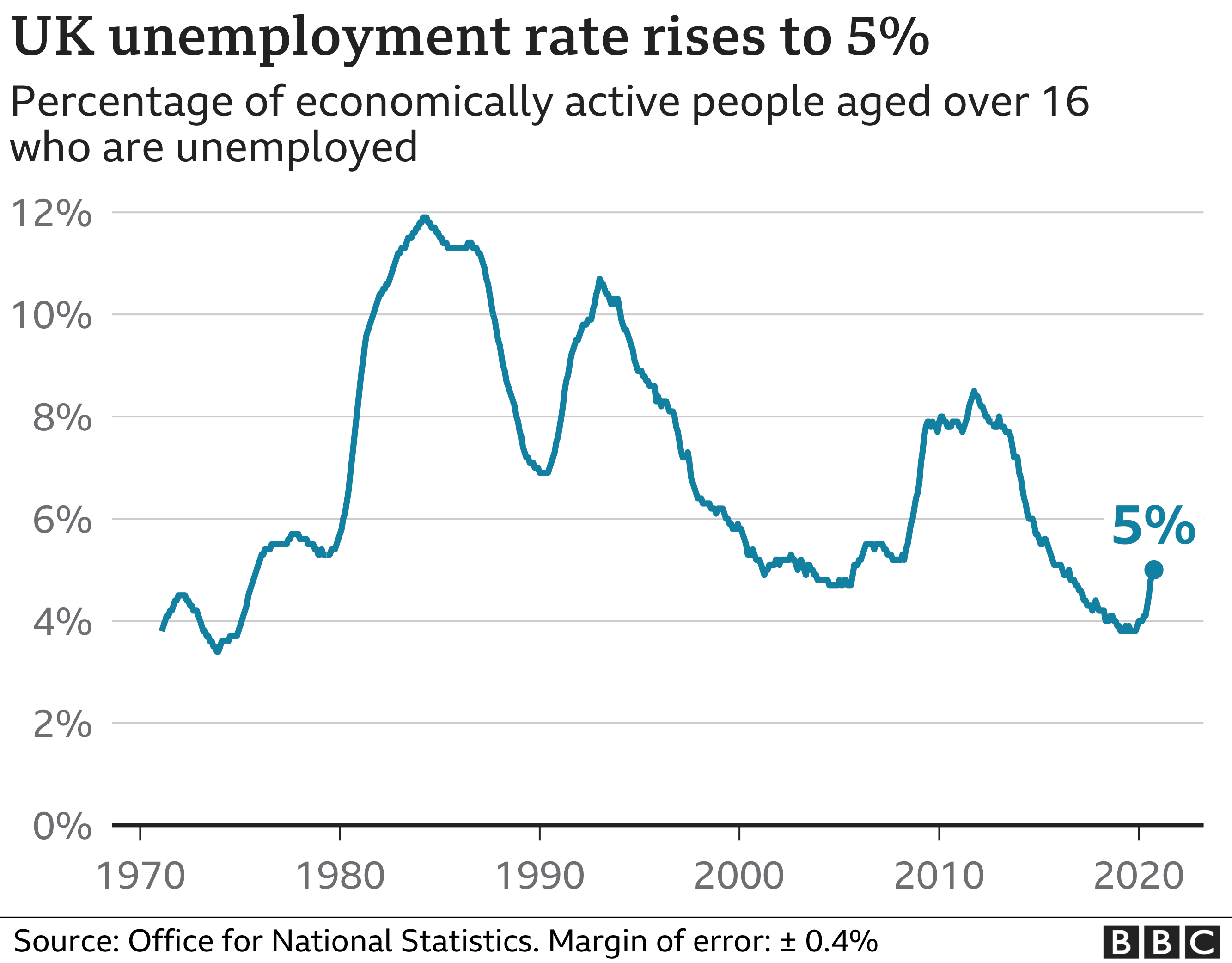

This week’s UK labour market figures are expected to show job vacancies running hot. Vacancies have scaled record highs in recent months and fears that the end of the furlough scheme would lead to a sharp increase in unemployment have proved unfounded.

Read More It’s not quite the Black Death, but worker shortage hits UK firms hard (msn.com)

Comment The real problem is that employers want cheap docile labour which is why they want more and amore migrants who will accept anything as better than the countries they have come from. R J Cook

The Western elite fear for loss of control and need Russia regime change – that is what Navalny was for and there has to be a link with the vanishing Skripals who have not been heard of since leaving hospital.

February 8th 2022

What Kirstie Allsopp doesn’t understand is the housing crisis is on a collision course with the cost of living

Vicky Spratt

Sometimes it’s worth stating the bleeding obvious: Britain has had a severe housing crisis for over a decade. There is a social housing shortage and house prices continue to reach record highs. This has pushed around 13 million people from all walks of life – those who would once have owned their own home and who would once have lived in social housing – into an increasingly engorged private rented sector where standards are low, stability is scarce and costs are also rising beyond wages to hit all-time highs.

January 26th 2022

Fed: Rate Hike ‘Soon’; What Is Web 3.0? Chinese New Year To Worsen Supply Chain Woes | NTD Business

Fed: Rate Hike ‘Soon’; What Is Web 3.0? Chinese New Year To Worsen Supply Chain Woes | NTD BusinessNTD BUSINESSPAUL GREANEY

The Federal Reserve will continue to withdraw economic stimulus as planned. It’s balancing a doubled edged sword, go too slow inflation could get worse, go too fast the economy could suffer. We have what it means for you.

YouTube, jumping on the web-three bandwagon – as new technologies grab the attention of content creators. But what exactly is web-three? We explain.

And the supply chain expected to get worse soon because of two upcoming events in china – the Chinese New Year and the winter Olympics.

Christian Dior takes to the runway for Paris Fashion Week, as the fashion world still wavers on how to cope with the Omicron variant.

And Slovakia gives the green light to a flying car prototype. What problem is the company behind it trying to solve?Read More Fed: Rate Hike ‘Soon’; What Is Web 3.0? Chinese New Year To Worsen Supply Chain Woes | NTD Business (theepochtimes.com)

LIVE: Fed Chair Announces Decision on Interest Rates

By Epoch Video January 26, 2022

Federal Reserve Chair Jerome Powell holds a news conference after the policy decision. The Federal Reserve is expected on Wednesday to announce that it is speeding up the end of its pandemic-era bond purchases and signal a turn to interest rate increases next year as a guard against surging inflation.

LIVE: Fed Chair Announces Decision on Interest Rates (theepochtimes.com)

Biden inflation and economic woes unlikely to be fixed in time for midterm elections

by Zachary Halaschak, Economics Reporter

President Joe Biden and Democrats will likely be dealing with the fallout from high inflation throughout the year, a prospect that bodes poorly for Democratic prospects in the midterm elections.

Inflation has soared. Consumer prices grew 7% in the 12 months ending in December, the fastest pace since 1982. Because of the inflation, the Federal Reserve is gearing up to hike interest rates several times this year and appears on track to be even more hawkish in its 2022 monetary policy than was thought even just weeks ago.

Read More ‘Biden-flation,’ economic woes won’t likely be fixed by midterm elections | Washington Examiner

January 21st 2022

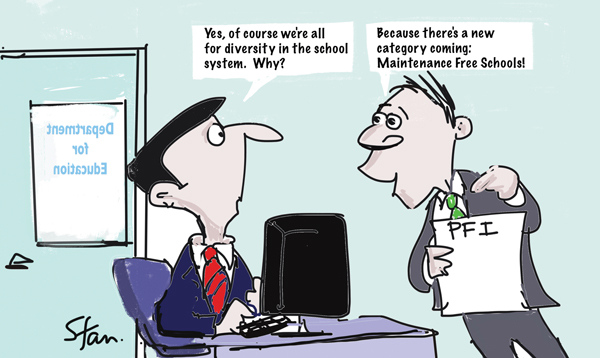

Weekly Comic: Europe Learns to Start Worrying as Putin Applies the Pressure

Investing.com

Investing.com — Russia is on the verge of invading a European neighbour for the third time in 14 years. Unlike the last two, this one could have a real economic impact. In August 2008, it hardly mattered to the global economy that Russia had invaded Georgia. Oil prices were rapidly collapsing, but the world was much more concerned with the collapse of the U.S. financial system.

Read More Weekly Comic: Europe Learns to Start Worrying as Putin Applies the Pressure (msn.com)

January 19th 2022

Improved finances mean no ‘one shot’ for Williams designers

Michelle Foster

Not quite smiling all the way to the bank but certainly more comfortable than they have been in recent times, Williams go into 2022 knowing they have the budget to develop the car.

That, says CEO Jost Capito, has given the designers a bit of breathing room as they don’t have just “one shot” to get it spot on this season.

Formula 1 enters a new era this year, one in which the sport has adopted ground-effect aerodynamics in a bid to improve the racing.

Read More Improved finances mean no ‘one shot’ for Williams designers (msn.com)

Archive 2021

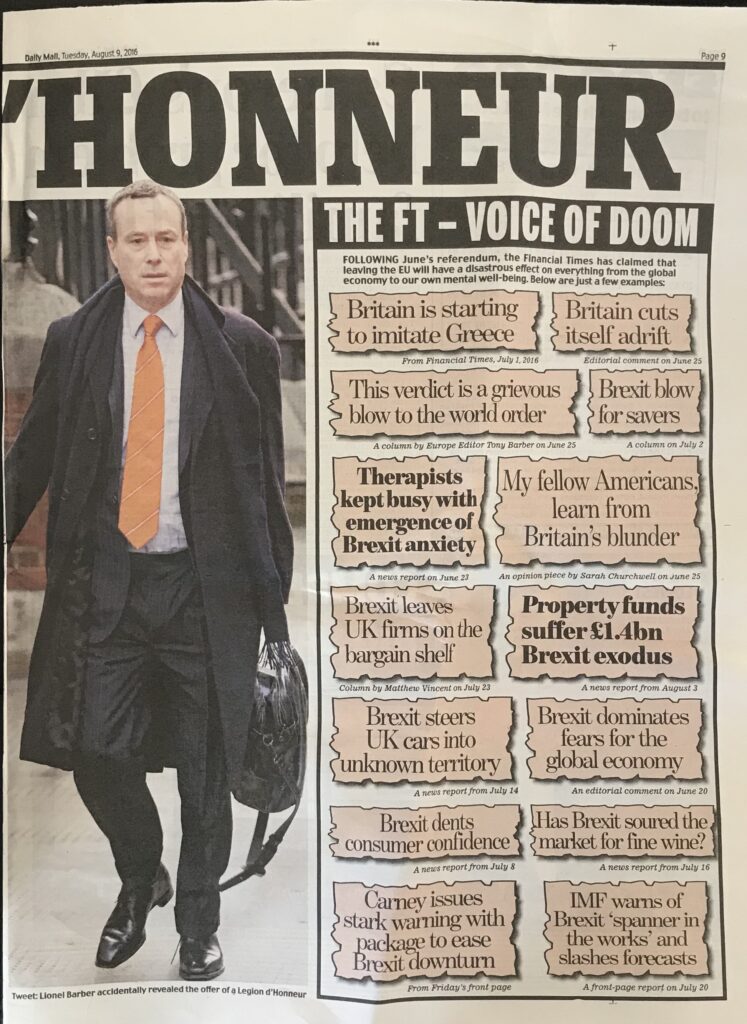

US overtakes Europe after Brexit liberates City of London

Lucy Burton, Louis Ashworth, Ben Gartside

British financial services exports to the US outstripped those to the European Union in 2020 for the first time since the Brexit vote as the City shifts its focus away from the Continent.

Read More US overtakes Europe after Brexit liberates City of London (msn.com)

Facebook stock nosedive costs Zuckberg $6bn as whistleblower interview and service outage rattle investors – October 5th 2021

Oliver O’Connell

Shares in Facebook fell sharply on Monday in the aftermath of the explosive interview with whistleblower Frances Haugen and as its companies experienced an extended service outage.

Building industry paralysed as cost of supplies soars amid ‘perfect storm for construction’, economists warn – September 6th 2021

Most of New Zealand to emerge from lockdown on TuesdayGrandpa at 35?! Celebrities who became grandparents really young

Builders are being forced to down tools amid a “perfect storm for construction” which is putting the UK’s economic recovery in doubt, industry groups have warned.

Shortages of both labour and materials are piling pressure on the construction industry- PA Wire

The cost of building materials has soared by 20 per cent, exacerbating the problems facing an industry worth around £117bn to the UK economy.

Astonishing array of guests at banker’s birthday including Theresa May- September 5th 2021

Mark Hookham For The Mail On Sunday

You’ll be sorry when Gove puts the moves on No 10Director Andrew Haigh on Filming ‘The North Water’: “I Was Like, ‘Oh My God…

As guest lists go, it had to be the one of the most eclectic birthday party gatherings of recent times.

Read More Astonishing array of guests at banker’s birthday including Theresa May (msn.com)

‘I’m utterly sick of it’: UK workers on the return of the commute August 28th 2021

Clea Skopeliti

Pop-up vaccination centres for areas with low levels of uptake on the wayOne to watch: Nala Sinephro

Read More ‘I’m utterly sick of it’: UK workers on the return of the commute (msn.com)

As September approaches, employers are increasingly asking workers to come in, with many offices adopting hybrid systems after months of working from home – prompting mixed emotions. Commuting can be both expensive and polluting. UK workers pay more of their salary in commuting costs than their EU counterparts and, before the pandemic, two-thirds of people travelled to work by car.

Threat of soaring inflation rises as 150,000 job losses loom – August 2nd 2021

Covid-19 hospital admissions in England may have peaked, figures…The most expensive music videos of all time

The UK faces its highest inflation for a decade as the end of furlough threatens to put another 150,000 people out of work, a leading think tank has warned.

The latest forecasts from the National Institute of Economic and Social Research (NIESR) predicted the Consumer Prices Index could hit 3.9pc early next year – the highest since November 2011 and almost double the Bank of England’s 2pc target.

The think tank said the spike would be driven by reopening pressures, as well as the effect of VAT rising after cuts to help firms survive the pandemic, before returning to 2pc in 2023.

However, the inflation warning came days before the Bank’s latest policy decision this week, amid splits among rate-setters over the extent of the UK’s post-Covid inflation threat.

NIESR added that the Bank could struggle to extricate itself from its quantitative easing stimulus efforts despite the strength of the recovery potentially meriting “the tapering or even ending” of the current £150bn round of bond purchases.

The forecaster echoed the criticisms of July’s House of Lords report into a Bank “addicted” to money printing, and said a reversal of the policy could cause financial turmoil due to Threadneedle Street’s “lack of preparation and clear communication about the speed and effect of ending QE”.

Hande Kucuk, the think tank’s deputy director, said inflation would remain above the Bank’s target for “the most part of next year”.

“Given the uncertainties regarding the exit from QE, the Bank should follow a carefully communicated gradual approach to avoid a significant tightening in financial conditions that might risk the ongoing recovery from the pandemic,” she warned.

The Bank is expected to set out more details on its strategy for unwinding its asset purchases on Thursday.

The forecaster is pencilling in a faster bounce back for the UK this year, raising its 2021 growth forecast from 5.3pc to 6.8pc – with a 5pc pace expected between April and June alone as the economy reopened.

However, the economy will also be 3pc smaller compared to its post-financial trend, representing a cumulative £735bn in lost growth by 2025, it added.

NIESR also expected the unemployment rate to reach 5.4pc by the end of the year, swelling unemployment numbers by 150,000 after the furlough is wound up at the end of September.

It said young people would also bear the brunt of the pandemic over the longer term, as the number of unemployed 18 to 24-year-old men more than doubles to 424,000 by 2022-3, compared to 199,000 before Covid struck. The number of unemployed young women is also set to rise 70pc above 2019-20 levels.

The forecasts came as the Chancellor, Rishi Sunak, reiterated that “there are no plans to extend furlough” beyond its scheduled finish at the end of September.

He told a LinkedIn event: “I’m confident that with the pace of the economic reopening and people’s hiring intentions, that actually the vast majority of people will be able to come back to work.”

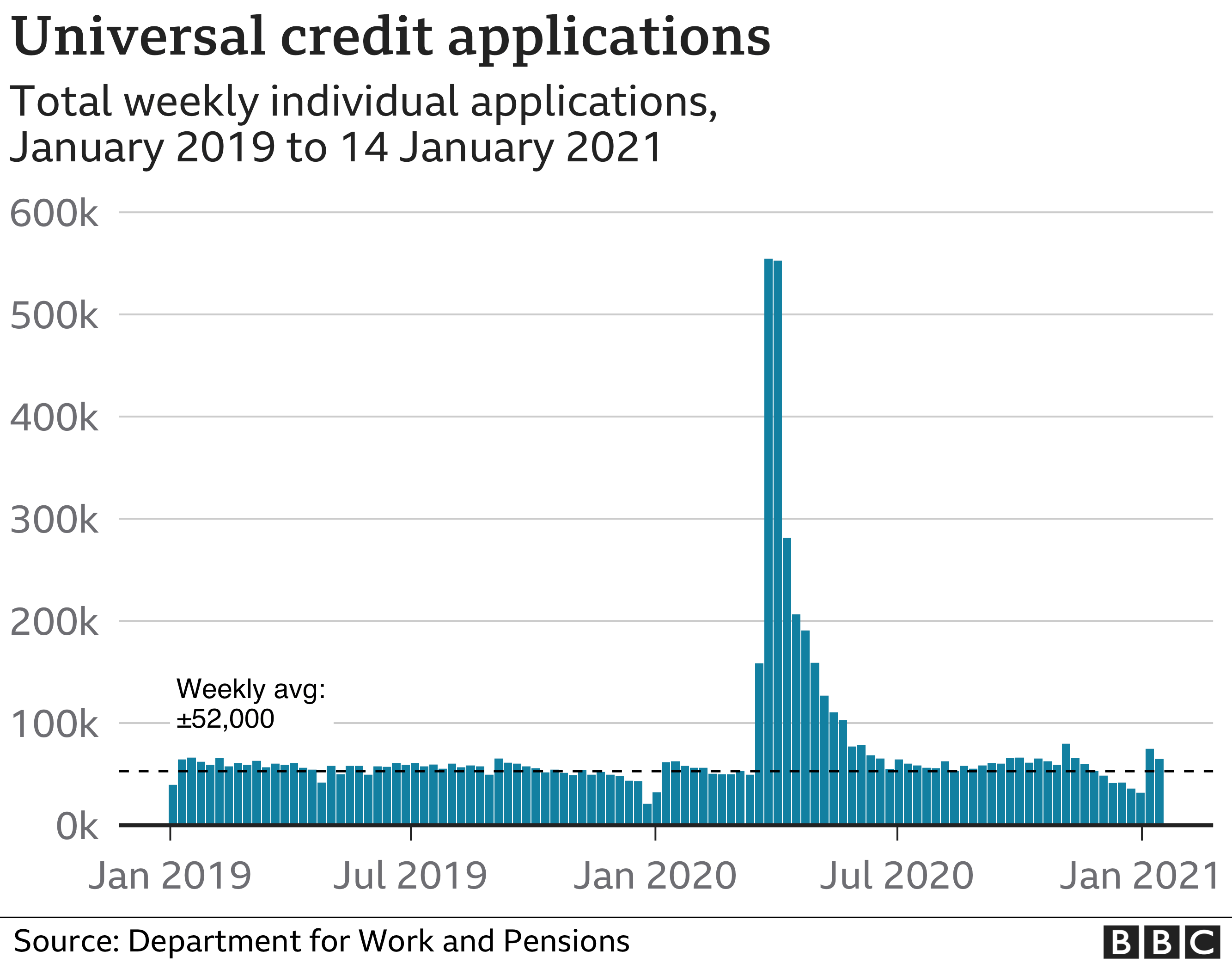

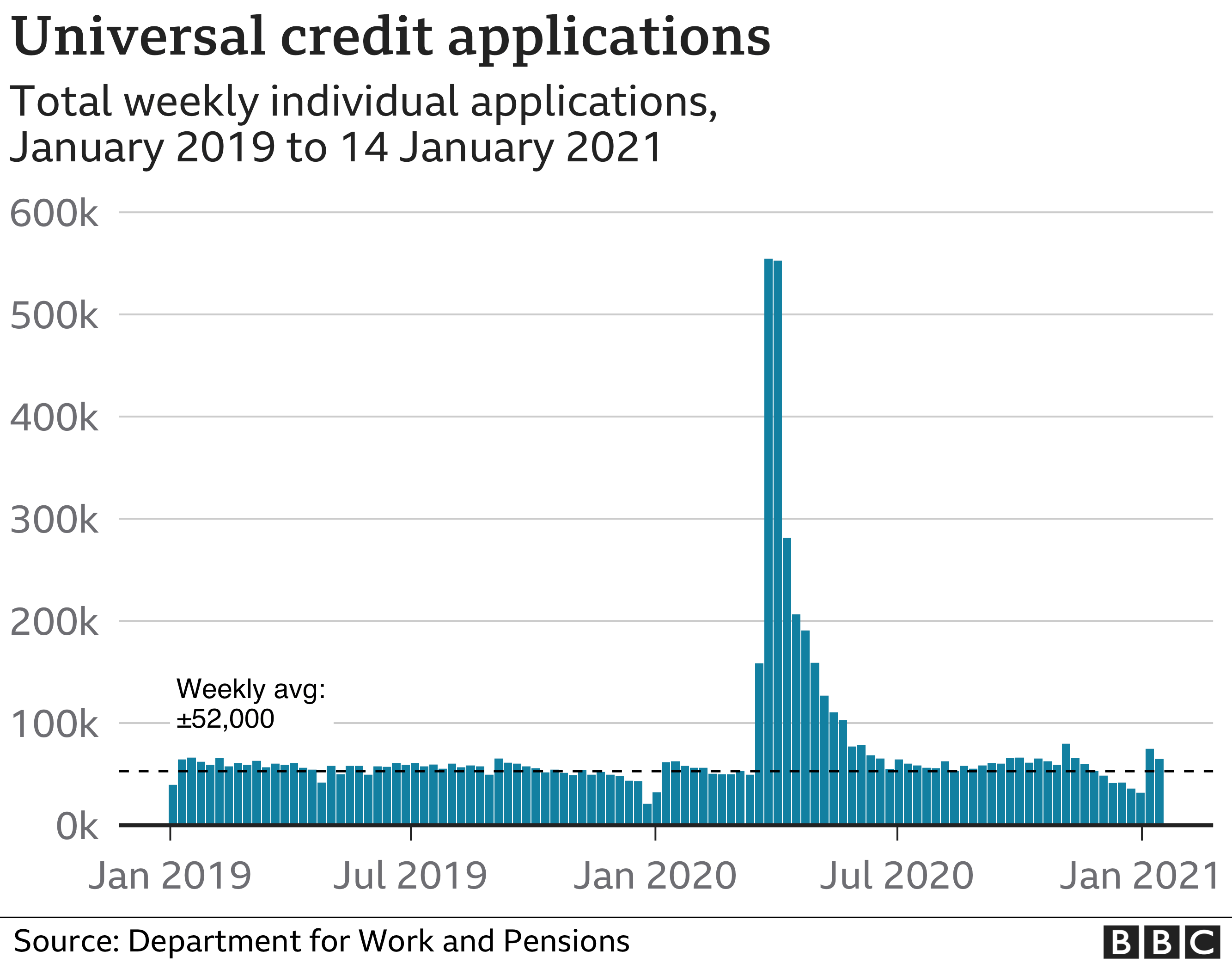

NIESR also called for new targeted welfare measures after the end of the furlough, as well as an extension of the £20 a week Universal Credit increase to be extended “so that the extreme poor can receive sustenance without further sacrifices”.

It added that Mr Sunak’s cuts to the international aid budget earlier this year would generate negligible direct savings while potentially hitting UK jobs, and should be reconsidered.

800,000 workers at risk of leaving central London in Covid exodus

June 29th 2021

Louis Ashworth, Tom Rees

Around two out of five people living in the capital’s 14 central boroughs could do their roles from elsewhere, according to analysis by consultancy Advanced Workplace Associates (AWA).

The research, based on Office for National Statistics data, found that customer service, administration, managerial and a significant amount of civil service work could be shifted further afield.

However, roles in healthcare, education and skilled trades are unlikely to be relocated from London, the report said.

Andrew Mawson, managing director of AWA, said a permanent shift to home working could “prompt a rethink of the role of central London” in the longer term.

He said: “Employers will wonder whether they need as much expensive inner London office space, and workers will question whether they need to spend time and money commuting if they don’t need to.”

Visitor numbers to retail destinations in the capital remain depressed as restrictions on international travel and work from home guidance hits tourism and commuter levels.

Footfall across central London’s high streets and shopping centres was 53pc lower last week than the same week in 2019, in contrast to regional cities outside of the capital where visitor numbers were down by 28pc, according to data experts Springboard.

The Bank of England’s chief economist predicted that the exodus to the suburbs caused by home working will provide a boost for the Government’s levelling-up drive.

Andy Haldane, who will leave the Bank this summer, said households have been “voting with their feet” by moving to rural and suburban areas, causing house prices to rise faster than in cities.

Speaking at an online event on Monday, he said: “If that were to persist, that would provide something of a tailwind to the levelling up agenda.”

Mr Haldane said that before the pandemic hit, workers tended to “swarm” to big cities. However, he added that a “hollowing out” had occurred during the crisis, a trend that could help prevent wealth and the highest earners being concentrated in cities if it continued.

He said: “There’s already some signs that some of those shifts appear to be of a durable nature as people seek out residential accommodation with a bit more space, either suburban or in the rural parts of the UK.”

Traders & Billionaires’ Delight As They Push Up Oil Prices – June 16th 2021.

Brent crude was up 69 cents, or 0.9%, at $74.68 a barrel by 0200 GMT, having risen 1.6% on Tuesday.

U.S. crude gained 66 cents, or 0.9%, to $72.78 a barrel, after rising 1.7% in the previous session.

“Even non-energy traders are placing bets that oil prices will continue to rise,” said Edward Moya, senior market analyst at OANDA.

“Everyone is turning overly bullish with crude prices. The crude demand outlook is very robust as recoveries across the US, Europe and Asia, will have demand return to pre-COVID levels in the second half of next year,” Moya said.

U.K Pensions – June 15th 2021

Rishi Sunak will have to spend up to £4bn more on pensioners from next year if he sticks to the Conservative party’s “triple lock” pledge, despite refusing to boost funding for schools or welfare as he attempts to tighten the nation’s purse strings.

Anomalies in wages data pushed the headline growth rate of average UK earnings up to 5.6 per cent in April, with economists forecasting that the rate will rise to about 8 per cent by July.

If the chancellor sticks to the Tories’ triple-lock vow — which ensures that state pensions rise annually by the highest out of average earnings growth, inflation or 2.5 per cent — the government will have to increase pensions by the headline rate in July. The Office for National Statistics and economists say that the true rate of earnings growth is much lower.

Comment This is necessary to make shale gas and fracking viable. The ruling elite brought us two world wars. They have no genuine concern for the environment or planet. Robert Cook

Calling Time on U.K Pubs – June 5th 2021

The bottom line is that the top heavy NHS cannot cope with the massive increase in demand caused by extended life span, mass immigration and poor life styles.

Lockdown will exacerbate rather than cure these ills and exacerbate these problems-masks add to the mental health issues by promoting fear driven social isolation and anxiety. Robert Cook

The government is being urged to remove all restrictions on hospitality businesses on 21 June, as reports suggest that the final stage of England’s roadmap out of lockdown could be delayed by two weeks.

The British Beer & Pub Association has warned that thousands of pubs “could still be lost forever”, even though indoor service returned on 17 May.

Figures suggest that pubs suffered a 20% fall in trade in the first week after reopening compared with the same period before the pandemic – and if this continues, the average venue could lose £94,000 in turnover a year.

This would mean that the typical pub would need to sell close to 25,000 additional pints over a 12-month period to make over the shortfall.

Equality ? May 19th 2021

You would think being the child of a billionaire comes with a series of perks. For Bill and Melinda Gates’ three children, it’s slightly more complex. After Bill Gates continuously mentioned he’s leaving his children a $10 million apiece inheritance, it seems his children might receive more thanks to their mother, Melinda.

To be honest, we’d be content with $1 million alone, but alas; we’re not the offspring of a tech billionaire with an estimated $120 billion fortune.

According to divorce experts, Melinda may seek to change her three children’s inheritance, after taking the apparently unusual measure of naming top trust and estate lawyers as her representatives in her divorce filing.

Earlier this month, news of Bill and Melinda’s separation broke the internet, with the power couple announcing they were ending their 27-year marriage in a statement.

“Over the last 27 years, we have raised three incredible children and built a foundation that works all over the world to enable all people to lead healthy, productive lives,” the pair wrote. “We continue to share a belief in that mission and will continue our work together at the foundation, but we no longer believe we can grow together as a couple in this next phase of our lives. We ask for space and privacy for our family as we begin to navigate this new life.”

What initially started as an amicable split, with the intent to continue philanthropic ventures together, swiftly became more complicated. Reports of a long relationship between Bill Gates and late billionaire financier Jeffrey Epstein have been back in the news, as well as resurfaced allegations of Gates’ affair with a former Microsoft employee.

In her divorce filing, Melinda said a separation agreement was in place, and if the parameters of the children’s inheritance are not detailed in the pact, sources say either party could change the details.

Bill has remained open about the amount of money he plans to leave his children, Jennifer, 25, Rory, 21, and Phoebe, 18, saying: “I definitely think leaving kids massive amounts of money is not a favor to them.” He added that while certain individuals might disagree with that, he and Melinda “feel good about it.”

Top divorce lawyer Robert Cohen of Cohen Clair Lans Greifer Thorpe & Rottenstreich will be representing Melinda. His clients have included Michael Bloomberg and Ivana Trump. In addition, Melinda has enlisted estate planning attorney Loretta Ippolito of Paul Weiss, as well as the firm’s Bruce Birenboim, who has repped Citigroup and the NFL.

UK housing crisis: how did owning a home become unaffordable? Edited and Posted by Robert Cook April 13 2021

Buying a house is off-limits to many thanks to rising rents, pay freezes and a lack of affordable homes. But it hasn’t always been this way. What went wrong?

- Covid frontline workers priced out of homeowning in 98% of Great Britain

- How can we fix the UK housing crisis?

Lydia McMullan, Hilary Osborne, Garry Blight and Pamela Duncan

Wed 31 Mar 2021 08.00 BST Last modified on Thu 1 Apr 2021 15.37 BST

The UK has a housing crisis: in recent decades the cost of buying a home has risen faster than wages, leaving many workers priced out of the market.

In some parts of the country, low-deposit mortgages are no help, because would-be homeowners cannot afford the monthly repayments on the mortgages they will need, leaving them in the position of needing to save large sums to put down.

High private sector rents make this difficult – and also mean that in some areas 40% of tenants need state help to pay their monthly housing bills. Affordable social housing has become scarcer, leaving many households with no choice but to rent – often paying more than they would for a mortgage.

Here is a short history of how we came to this point:

Year 2020

Average UK house price £238,211

£200,000

1970s

Things weren’t always like this …

At the beginning of the 1970s almost a third of homes across Great Britain were affordable social housing provided by local authorities, according to government data. This provided a decent alternative to home ownership. For those who could buy, the average price in the UK was £4,057. By the next decade things were beginning to look different.

The distribution of housing stock in Great Britain has changed significantly since 1970

Housing stock in Great Britain, by type of tenure 1970 – 2018

The right to buy is bad news for social housing – see More of Milton Keynes Building on the Vision by Robert Cook

The right to buy is a good place to start unpicking the current housing crisis. The scheme, which enabled council tenants to buy their homes for a reduced price, had existed for years, but the Thatcher government turbo-charged it with big discounts introduced in the Housing Act of 1980. Over time, the sums of money councils could keep to create new homes was reduced, and the number of replacement properties fell.

The number of council homes in Great Britain has declined steadily since 1980

Right to Buy

introduced

This led to a big leap in the number of homeowners in the UK

Within five years, in England alone half a million council homes had been sold under the initiative. Between right to buy sales, demolitions and the later transfer of properties to housing associations, the availability of council housing has plummeted since the 1980s.

1980s-1990s

Mortgages become more widely available … but the system gets riskier

At the same time as council housing stock was diminishing, something else was afoot. The financial sector began a large-scale deregulation that continued throughout the 80s. Mortgages became more readily available and lenders could charge what they wanted. The days of having to prove you could save before you could borrow were over, and more money came into the system.

1987

1988

The 1988 Housing Act further dents councils’ ability to house their communities

The 1988 Housing Act enabled housing associations to source private money to build new homes and repair existing ones. These independent not-for-profit organisations were originally funded by philanthropy, but in the 1970s were granted access to public funding to build homes. This new act gave them powers that councils did not have, so many transferred the ownership of homes to the associations. A quarter of a million houses had been transferred by 1997, and this practice continued under New Labour.

The act also introduced assured shorthold tenancies, which made owning a rental property more attractive to individual investors – another factor contributing to the rise in house prices.

Late 80s, early 90s

The housing market crashes

House prices rose significantly from 1983 onwards, but crashed at the end of the decade as interest rates rose to almost 15% and the economy fell into recession. The subsequent fall in the early 1990s led many borrowers into negative equity – their mortgages were bigger than the value of the homes they were secured on.

Some borrowers handed back their keys to their lender, others fell behind on payments. Repossessions rose, peaking at 75,500 in 1991. These homes went back on the market, depressing prices further.

Repossessions rose dramatically between 1989 – 1991 in England and Wales

1989 80,000

1990 60,000

1991 40,000

The big supply and demand problem rolls on

Fewer controls on mortgage lending meant more people could buy homes, but this was offset by the fact there were not enough homes being built. In 1992, the number of new homes completed in the UK was 179,100 – just over half the number built 20 years earlier. The growing demand drove up prices.

The yearly supply of new homes in the UK has declined since 1970

House prices rebound … but wages don’t keep up

From the end of 1993 house prices began rising again. Within 10 years mortgage payments went up from about a fifth of the average pay packet of a first-time buyer to approximately a third, according to the Nationwide affordability index.

1996

Buy to let goes mainstream

In September 1996 the Association of Residential Letting Agents (ARLA) and four lenders launched a “buy-to-let initiative”, making it easier for individuals to invest in property by offering specialist mortgages that take into account rental incomes. Over the next two decades falling interest rates and rising house prices persuaded more and more people that the property market was a good place to invest. In 2014, almost 200,000 buy-to-let mortgages were approved. Not only did this expand the rental market but it was another element driving house sale prices up.

1999

Northern Rock’s ‘high-risk mortgage’ signals madness in the market

Northern Rock launched its Together mortgage – a home loan that offered borrowers the chance to take on debt equal to 125% of the value of the property they were buying. The same year, the total number of new houses built by councils in England stood at a mere 50.

There are warnings over ‘liar loans’

Among the other innovations in the housing market were self-certification mortgages – these were designed to help the self-employed and other borrowers with incomes from multiple sources to get mortgages without showing payslips. But as the housing market took off in the early 2000s they became more commonplace, along with “fast-track” loans where incomes were not verified. Regulators and politicians started to become concerned about this part of the market.

Interest-only mortgages also became more common, as borrowers who could not afford to pay off some of their home loan each month took the cheaper option – and a gamble that house prices would continue to rise and they would be able to pay off the loan eventually. After the banking crisis strict rules were put in place to curb these kinds of lending.

The average UK house price reaches eye-watering levels … and then the credit crunch hits

House prices soared in Britain … and then the US firm Lehman Brothers filed for bankruptcy, triggering a global financial crash. UK lenders took riskier mortgage products off the market and significantly cut their lending. As a result, it became more difficult to get a mortgage, particularly as the recession hit people’s jobs and savings. Against a backdrop of dwindling social housing provision and out-of-reach mortgages, more people were pushed into private renting. The percentage of owner-occupied properties began to fall.

The average house price almost tripled between August 1990 and August 2007

A period of hardship for many is an opportunity for others

As the impact of the credit crunch rippled across the country, repossessions were kept in check by historically low interest rates and rules forcing lenders to do their best to help people keep their homes.

As well as helping people stay in their homes, this cheap credit made property look a good investment to those with spare cash, and over the next few years fuelled some parts of the market.

2009

The proportion of people living in council housing has shrunk

The percentage of homes provided by councils fell from 32% in 1977 to a mere 9% in Great Britain. The figure continued to fall the following decade, hitting 7% in 2018. For those who qualified for a mortgage, interest rates had never been lower – the base rate was slashed to just 0.5% and the cost of home loans fell too.

2010

The number of new homes built hits a new low

The number of new houses completed in the UK dropped to 135,990, the lowest figure since 1946. In 2013 it fell even further to 135,590. The population, however, continued to grow, increasing housing demand.

The UK’s population has risen by nearly 8 million since the turn of the century

The same year, the coalition government introduces ‘affordable rent’ … to raised eyebrows

The coalition government introduced a new form of tenure, called “affordable rent”. The hope was that making tenants pay up to 80% of the market rent – far above social housing rates – would enable more new houses to be built. These prices were far out of reach for many low-income earners in some parts of the country: Westminster council warned in 2013 that at 80% of market rates, households would have to earn £58,000 a year to afford a one-bedroom flat.

2013

Help to buy is born

The housing market outside London struggles after the banking crisis, construction is sluggish and first-time buyer numbers fall as lenders still demand large deposits. Then the government makes “a dramatic intervention to get our housing market moving” with the launch of two help-to-buy-schemes – one offering loans on brand new homes, which builds on an existing scheme for first-time buyers, the other offering mortgage lenders government guarantees so they can start providing 95% mortgages again.

A week after the budget economists from the independent Office for Budget Responsibility warn that help to buy will push up prices and have little impact on demand.

George Osborne raises tax bills for landlords

For years landlords had benefited from cheap borrowing – made cheaper by rules allowing them to claim tax relief of up to 45% on their mortgage interest.

The then chancellor, George Osborne, surprised many with his spring budget when he announced this tax break would be cut to 20% in 2017, and that there would no longer be an automatic right to claim relief worth 10% of the rent for wear and tear. In November 2015 he delivered another hit – announcing a 3% surcharge on second homes to be introduced the following April. The moves meant landlords no longer had an advantage over first-time buyers.

The then prime minister, Theresa May, gets rid of the cap on what councils can borrow to build homes. The hope is that this will increase council housing provision – but only by an estimated 10,000 new homes a year. A year after the announcement was made, research found that some councils had already started building, and until the pandemic hit they had been expected to reach the government’s target.

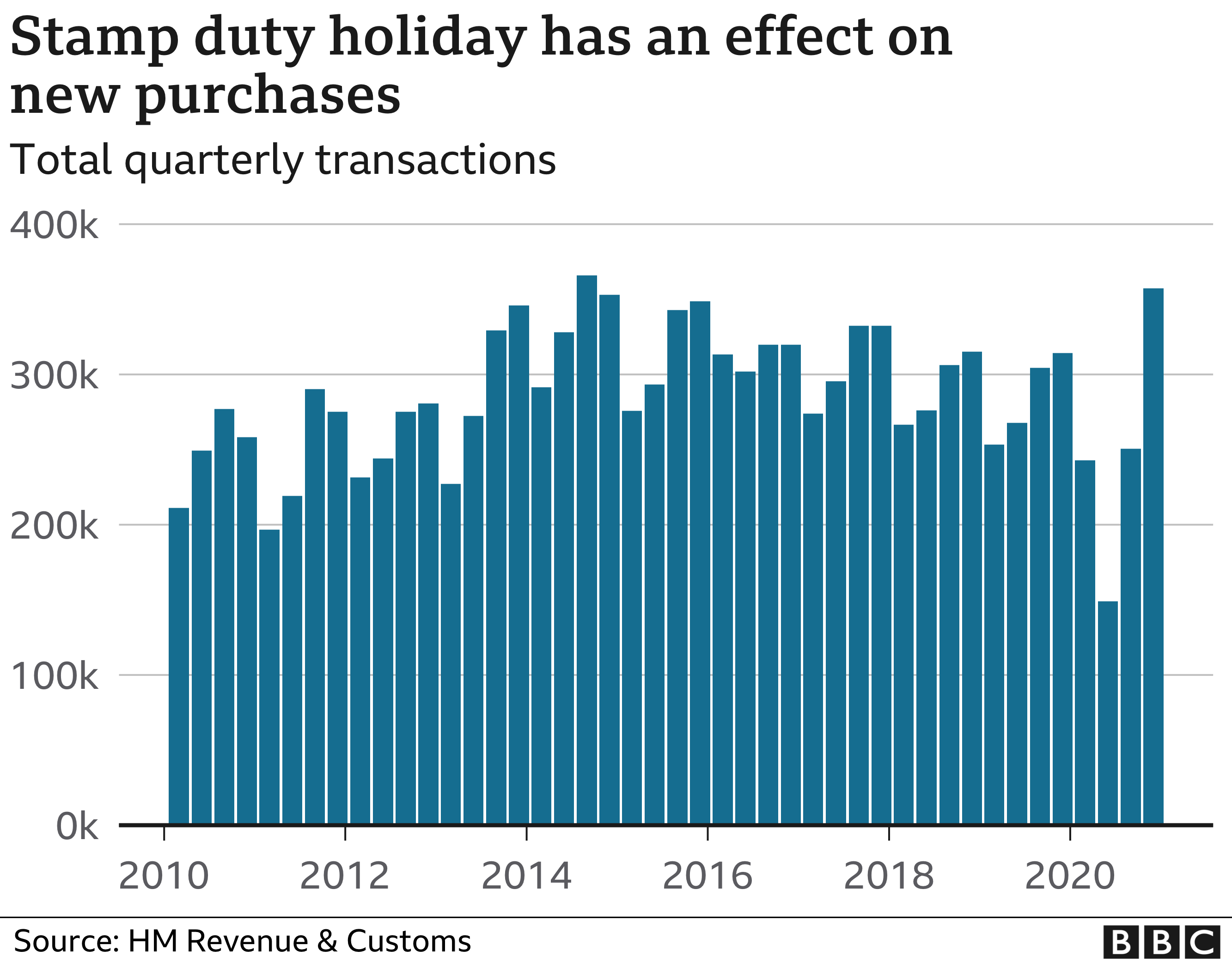

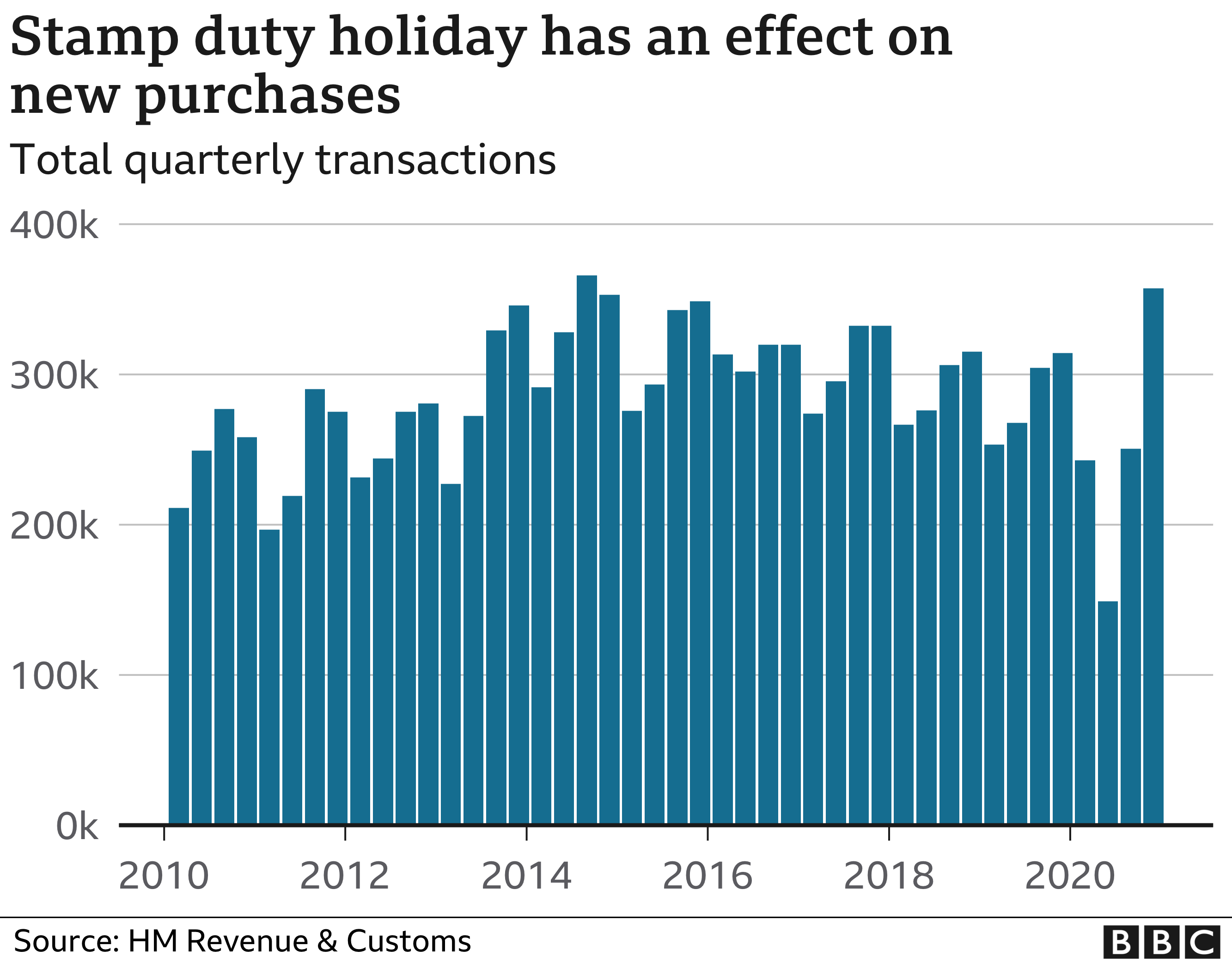

The housing market went into lockdown in March, but despite a deadly pandemic disrupting most areas of the economy, once it reopened business boomed. UK house prices climbed by 8.5% during 2020, according to figures from the Office for National Statistics. The price rise was partly fuelled by a rush to buy during the stamp duty holiday in England and Wales that is set to end in June 2021, with rates returning to usual after the end of September, and partly by a “race for space” with larger homes becoming more prized.

House prices rose steadily from May 2020 despite the pandemic

Years of selling off social housing followed by more than two decades of a property market fuelled by cheap credit have put households who do not own homes in a difficult position. High rents make it hard to save enough for mortgages that would cost less each month. Runaway house prices mean that for some it is impossible to ever save a big enough deposit to raise a mortgage. Low interest rates make property attractive to investors, and help those who can afford a deposit raise big sums to buy – but they are no help to those who are saving up.

Putting things right will not be simple, but there are things that can be done to improve the situation.

*Note: The UK yearly average house price shown is a calculation of the mean value of the HPI UK monthly averages.

NEED TO BE ECONOMICAL WITH LANGUAGE AND TRUTH IN THE NAME OF EQUALITY BUT TO HIDE UGLY TRUTH OF AN OBSCENE ECONOMIC SYSTEM WHERE RICH GET EVER RICHER AND MORE POWERFUL – THE LOWER ORDERS TAKE THE BLAME – April 13th 2021

The harmful ableist language you unknowingly useShare using EmailShare on TwitterShare on FacebookShare on Linkedin(Image credit: Alamy)

By Sara Nović5th April 2021Some of our most common, ingrained expressions have damaging effects on millions of people – and many of us don’t know we’re hurting others when we speak.I

I like being deaf. I like the silence as well as the rich culture and language deafness affords me. When I see the word ‘deaf’ on the page, it evokes a feeling of pride for my community, and calls to me as if I’m being addressed directly, as if it were my name.

So, it always stings when I’m reminded that for many, the word ‘deaf’ has little to do with what I love most – in fact, its connotations are almost exclusively negative. For example, in headlines across the world – Nevada’s proposed gun safety laws, pleas from Ontario’s elderly and weather safety warnings in Queensland – have all “fallen on deaf ears”.

This kind of ‘ableist’ language is omnipresent in conversation: making a “dumb” choice, turning a “blind eye” to a problem, acting “crazy”, calling a boss “psychopathic”, having a “bipolar” day. And, for the most part, people who utter these phrases aren’t intending to hurt anyone – more commonly, they don’t have any idea they’re engaging in anything hurtful at all.

However, for disabled people like me, these common words can be micro-assaults. For instance, “falling on deaf ears” provides evidence that most people associate deafness with wilful ignorance (even if they consciously may not). But much more than individual slights, expressions like these can do real, lasting harm to the people whom these words and phrases undermine – and even the people who use them in daily conversation, too.

Not a small problem

About 1 billion people worldwide – 15% of the global population – have some type of documented disability. In the US, this proportion is even larger, at about one in four people, with similar rates reported in the UK.

Despite these numbers, disabled people experience widespread discrimination at nearly every level of society. This phenomenon, known as ‘ableism’ – discrimination based on disability – can take on various forms. Personal ableism might look like name-calling, or committing violence against a disabled person, while systemic ableism refers to the inequity disabled people experience as a result of laws and policy.

Sara Nović discusses writing with students at the Rocky Mountain Deaf School in Colorado, US (Credit: Sara Nović)

But ableism can also be indirect, even unintentional, in the form of linguistic micro-aggressions. As much as we all like to think we’re careful with the words we choose, ableist language is a pervasive part of our lexicon. Examples in pop culture are everywhere, and you’ve almost certainly used it yourself.

Frequently, ableist language (known to some as ‘disableist’ language) crops up in the slang we use, like calling something “dumb” or “lame”, or making a declaration like, “I’m so OCD!”. Though these might feel like casual slights or exclamations, they still do damage.

Jamie Hale, the London-based CEO of Pathfinders Neuromuscular Alliance, a UK charity run for and by people with neuromuscular conditions, notes that the potential for harm exists even if the words are not used against a disabled person specifically. “There’s a sense when people use disableist language, that they are seeing ways of being as lesser,” says Hale. “It is often not a conscious attempt to harm disabled people, but it acts to construct a world-view in which existing as a disabled person is [negative].”

Using language that equates disability to something negative can be problematic in several ways.

First, these words give an inaccurate picture of what being disabled actually means. “To describe someone as ‘crippled by’ something is to say that they are ‘limited’ [or] ‘trapped’, perhaps,” says Hale. “But those aren’t how I experience my being.”

Disability as metaphor is also an imprecise way to say of saying what we really mean. The phrase ‘fall on deaf ears’, for example, both perpetuates stereotypes and simultaneously obscures the reality of the situation it describes. Being deaf is an involuntary state, whereas hearing people who let pleas ‘fall on deaf ears’ are making a conscious choice to ignore those requests. Labelling them ‘deaf’ frames them as passive, rather than people actively responsible for their own decisions.

Ableist language crops up in the slang we use, like calling something “dumb” or “lame”, or making a declaration like, “I’m so OCD!”

Hale adds that using disability as a shorthand for something negative or inferior reinforces negative attitudes and actions, and fuels the larger systems of oppression in place. “We build a world with the language we use, and for as long as we’re comfortable using this language, we continue to build and reinforce disableist structures,” they say.

Say what?

If ableist language is so harmful, why is it so common? Why might someone who would never purposefully insult a disabled person outright still find ableist expressions among their own vocabulary?

Ableist language as colloquialism functions like any other slang term: people repeat it because they’ve heard others say it, a mimicry that on its face suggests use is undiscerning. However, according to University of Louisville linguistics professor DW Maurer, while anyone can create slang term, the expression will only “gain currency according to the unanimity of attitude within the group”. This suggests ableist slang is ubiquitous because, on some level, the speakers believe it to be true.

It’s possible for individuals to be truly unconscious of these biases within themselves, and unaware of the ableism couched in their own everyday sayings. But the fact is, discussions about the negative effect of a word such as “dumb” – a term originally denoting a deaf person who did not use speech, but which now functions as slang for something brutish, uninteresting or of low intelligence – have been happening in deaf and disabled circles for centuries.

According to Rosa Lee Timm, the Maryland, US-based chief marketing officer of non-profit organisation Communication Service for the Deaf, these conversations have remained largely unexamined by the mainstream because non-disabled people believe that ableism doesn’t affect them, and ableist language perpetuates and justifies that belief.

“Ableist language encourages a culture of separation. It defines, excludes and marginalises people,” says Timm. She adds that this allows non-disabled people to be bystanders in the face of ableist culture infrastructure at large.

A boomerang effect

Although these words and phrases are obviously harmful to the groups they marginalise, non-disabled people who casually use ableist language may be negatively impacting themselves, too.

“What happens to this group of hearing, non-disabled people later in life – be it hearing loss, an accident, a health issue, aging or any number of things – when they transition to the disabled community?” says Timm. “The ableist language they used has created an oppressive environment.”

One of the most effective ways to move away from ableist language is understanding the disabled community, having conversations and listening to their concerns (Credit: Alamy)

Timm notes this ‘environment’ includes an impact on their own self-worth. “Beauty standards are a good comparison, in terms of language’s psychological power,” she says. “As a parent, if I say, ‘wow, that’s beautiful’ or ‘that’s ugly’, my children see that and internalise it… This can have a profound impact, particularly if they examine themselves and feel like they don’t match the standard… The same goes for ability.”

Hale seconds the idea that nondisabled people who experience disability later in life will be harmed by the rhetoric they use today. They also note that the divisive nature of ableist language can even have a negative impact on people who will never experience disability.

“It hurts all of us when we de-humanise ways of being, and construct them wholly in the negative,” they say.

Dismantling ableist structures

Given how ingrained ableism is in our society, rooting it out may seem an overwhelming task. Being aware of the words you use each day is a necessary step in the process. “Dismantling disableist structures doesn’t start with language, but building a world without them requires that we change our language,” says Hale.

Examining your own go-to phrases and attempting to replace them with less problematic synonyms is a good start. “Think about what you mean. Don’t just repeat a phrase because you’ve heard it, think about what you’re trying to convey,” says Hale.

Often avoiding ableist euphemisms just means choosing more straightforward and literal language – rather than “fall on deaf ears”, one might say “ignoring” or “choosing not to engage”.

Language is ever-changing, so eliminating ableism from your vocabulary will be an ongoing process rather than a static victory. You may stumble, but checking in with disabled people is an effective way to find your footing and continuing to build a more inclusive vocabulary. “My advice is always to listen,” says Timm. “Ask questions, avoid assumptions, and start by listening to the people who are impacted the most. Think about whether your own word choice is contributing to their oppression.”

It may feel uncomfortable, but discomfort and vulnerability necessitate introspection, which Hale points to as keys to dismantling ableist attitudes. “According to [disability equality charity] Scope, two-thirds of the British population feel uncomfortable talking to a disabled person,” says Hale. “Why? If you can work out why you’re uncomfortable, you’re well en route to changing it.”

The Following Makes A Mockery Of Gender In Fighting On The Spurious Equality Issue. Equality Is About Wealth & Power Not Genitals. R.J Cook March 18th 2021

The very private life of Sir Chris Hohn – the man paid £1m a day Posted March 18th 2021

The hedge fund manager earns Britain’s biggest salary. He also avoids meat, likes yoga and supports Extinction Rebellion

Sir Chris Hohn, far right, pictured with singer Katy Perry, is one of Britain’s most generous philanthropists. Photograph: British Asian Trust/Twitter

Rupert Neate Wealth correspondent@RupertNeateFri 5 Mar 2021 18.03 GMT

Hedge fund manager Sir Chris Hohn once made a point of telling a high court judge that he was an “unbelievable moneymaker”. This week Hohn proved his point – definitively – when it was revealed that he paid himself just shy of £1m-a-day last year.

Hohn collected $479m (£343m) in annual dividend payments from his The Children’s Investment (TCI) fund in the biggest ever personal payday in the UK after doubling profits at his Mayfair hedge fund, run from an office a couple of doors down from Louis Vuitton’s flagship store.

The payout – which works out at £940,000 for every calendar day of the year, and is nearly 11,000 times the median UK full-time salary – has shone a fresh spotlight on Hohn, a billionaire who goes to extraordinary lengths to protect his privacy after receiving regular death threats.

As well as making money and picking boardroom fights, Hohn, who was once chancellor Rishi Sunak’s boss at TCI, is one of the nation’s biggest philanthropists.

He has pumped more than £4bn into his personal children’s charity. And in recent years he has taken on a second cause: the climate crisis, promising to use his fund’s $30bn of investments to “force change on companies who refuse to take their environmental emissions seriously”.

Well known in the City and on Wall Street as one of the most aggressive activist investors, it came as little surprise to Hohn’s friends that he was not prepared to wait for governments to take action on climate change.

An Extinction Rebellion protest by the elderly in London 2019. Chris Hohn is the group’s biggest donor. Photograph: Richard Baker/Alamy

Instead he has pumped money into Extinction Rebellion (XR), the “respectful disruption” campaign that has staged high-profile sit-in protests around the world. When Hohn was revealed as XR’s single biggest donor, he said: “Humanity is aggressively destroying the world with climate change and there is an urgent need for us all to wake up to this fact.”

Hohn, who has only given a handful of tightly controlled media interviews throughout his career, pleaded with the high court judge overseeing his 2014 divorce from Jamie Cooper-Hohn to ban the media from the courtroom.

However the request was denied, giving the public a glimpse into the billionaire’s surprisingly modest lifestyle, his motivations for making so much money, and why he didn’t view his wife of 17 years as worthy of half the family fortune.

Although he was in a fight over a huge amount of money, Hohn said his life’s mission was to give money away. “My life is actually about charity,” he told the court. “I learned very early on you cannot take money with you. It does not bring you happiness.”

He said he lived a “very simple lifestyle”, avoids meat and practises yoga. On hearing the evidence, the judge noted that the couple lived a “Swatch lifestyle” not a “jet-set lifestyle”.

Hohn grew up in Addlestone, Surrey, the son of a Jamaican car mechanic and a legal secretary. He first decided to give money to charity, he has said, while working in the Philippines, where as a 20-year-old he saw children living on a rubbish dump.

“I considered being a doctor and working in a caring profession,” Hohn, 54, told the court. “[But] a dream or aspiration without resources is just that.” He compared his ambition to become a philanthropist to other young people who set their hearts on being able to “play for Chelsea or be a top QC”.

Hohn studied accounting and economics at Southampton University, where a tutor suggested he go on to study for a masters in business administration at Harvard. He took their advice, and graduated in the top 5% of his class.

It was at a Harvard dinner party that Hohn met Jamie Cooper, who was studying for a masters at the John F Kennedy School of government. They married soon after and took each other’s names officially, but only Jamie used both surnames. They have four children, including a set of triplets.

Hohn worked for the private equity firm Apax Partners, before moving to the Wall Street hedge fund Perry Capital. Perry’s partners then posted him back to London where he ran the UK division.

He struck out on his own in 2003 setting up his own $500m fund TCI, which quickly attracted investment from some of the world’s top foundations and endowments including the Carnegie Corporation of New York and the Massachusetts Institute of Technology.

Jamie Cooper-Hohn leaves the high court after a divorce hearing in 2014. It was one of the most high profile divorces in British legal history. Photograph: Reuters/Alamy

The fund appealed to charities and foundations because it was structured so that one-third of management fees would go directly to the Children’s Investment Fund Foundation, a charity set up by the couple and run by Cooper-Hohn.

In an interview with the New York Times to promote the newly launched charity in 2008, Cooper-Hohn dismissed suggestions it had been set up as ploy to soften Hohn’s image as an activist investor unafraid to fight the boards of companies he had invested in.

Werner Seifert, the former chief executive of the German stock exchange, wrote a book about a boardroom battle with Chris Hohn called Invasion of the Locusts. Photograph: Martin Argles/The Guardian

In a new year card to family, Hohn once wrote he had had an “exceptionally exciting year overthrowing German CEOs”. One opponent – former Deutsche Börse boss Werner Seifert – was so angry after losing a boardroom battle with Hohn that he wrote a book about it entitled Invasion of the Locusts, where he described Hohn’s style as “poison”.

Hohn’s TCI was also instrumental in forcing Dutch bank ABN Amro into the arms of Royal Bank of Scotland in 2007 – a deal which just months later, when the banking crisis hit, was a key reason RBS had to be bailed out by the UK taxpayer.

Cooper-Hohn said the foundation “not about putting a warm and fuzzy face” on TCI. She said knowing that a share of the management fees went to the fund was “very much about keeping Chris motivated” to produce the highest returns possible.

Both TCI and the foundation flourished. The hedge fund now manages $30bn of investments and is regularly listed among the world’s best-performing funds. Last year’s mega payday was not that exceptional for Hohn. The previous year he was paid £200m, and accounts filed at Companies House for TCI Fund Management (UK) Limited, which is 100% owned by Hohn, show that it holds total shareholder funds of almost $2bn.

The charity holds almost $6bn of assets and gave away $386m in 2019, according to the latest available accounts. However, the foundation no longer collects one-third of TCI’s management fees, following the couple’s divorce. Instead, Hohn can give to the charity at his discretion.

The divorce reached the high court after Hohn refused to give Cooper-Hohn half of their assets, arguing that the extraordinary wealth he had generated constituted a special contribution to the marriage. He claimed she was only entitled to 25%.

Her lawyer said the marriage was “what most marriages are: a partnership. How can it be possibly be fair that a couple who have agreed how to run their lives together for the wife to only receive a quarter of the assets?”

After weeks of arguments – which included Hohn calling Goldman Sachs bankers “idiots” and describing former Spain and Chelsea striker Fernando Torres as “worthless” – the judge awarded Cooper-Hohn 36% – or $530m – of her former husband’s fortune.

Cooper-Hohn later won another court battle forcing Hohn’s CIFF charity to pay £270m to a charity set up by his ex-wife.

Women are not inherently good Posted March 13th 2021

Published 7 years ago

on October 1, 2013